Maximize Your Returns: Understanding and Utilizing an Options Profit Calculator

In the dynamic world of options trading, making informed decisions is paramount. An options profit calculator is an indispensable tool for traders looking to assess potential profitability and risk before executing a trade. This article will delve into the functionality, benefits, and practical applications of an options profit calculator, equipping you with the knowledge to navigate the complexities of options trading with greater confidence.

What is an Options Profit Calculator?

An options profit calculator is a software tool or online application designed to estimate the potential profit or loss from an options trade. It takes into account various factors, including the strike price, premium paid or received, underlying asset price at expiration, and any commissions or fees. By inputting these variables, traders can visualize the potential outcome of their options strategy under different market scenarios.

Essentially, it provides a “what if” analysis, allowing traders to explore various possibilities and make more strategic decisions. This proactive approach can significantly mitigate risk and improve the likelihood of profitable trades.

Key Inputs for an Options Profit Calculator

To effectively use an options profit calculator, understanding the required inputs is crucial. Here are some of the essential elements:

- Underlying Asset Price: The current market price of the asset (stock, index, ETF, etc.) on which the option is based.

- Strike Price: The price at which the option holder can buy (call option) or sell (put option) the underlying asset.

- Premium: The price paid (for buying options) or received (for selling options) for the option contract.

- Expiration Date: The date on which the option contract expires.

- Number of Contracts: The quantity of option contracts being traded.

- Commissions and Fees: Any brokerage fees or commissions associated with the trade.

By accurately inputting these data points, the options profit calculator can generate a comprehensive profit/loss scenario.

Benefits of Using an Options Profit Calculator

The advantages of incorporating an options profit calculator into your trading strategy are numerous:

Risk Management

One of the primary benefits is enhanced risk management. By simulating various price scenarios, traders can identify potential downside risks and adjust their strategies accordingly. This allows for a more conservative and controlled approach to trading.

Strategy Optimization

An options profit calculator facilitates the optimization of trading strategies. It enables traders to compare different option strategies (e.g., covered calls, protective puts, straddles, strangles) and determine which one best aligns with their risk tolerance and profit objectives. [See also: Understanding Options Trading Strategies]

Improved Decision-Making

Informed decision-making is at the heart of successful trading. The calculator provides clear, visual representations of potential outcomes, empowering traders to make more rational and data-driven choices, rather than relying on gut feelings or speculation.

Time Efficiency

Manually calculating potential profits and losses for various scenarios can be time-consuming and prone to errors. An options profit calculator automates this process, saving valuable time and ensuring accuracy.

Educational Value

For novice traders, an options profit calculator serves as an excellent educational tool. It helps them understand the mechanics of options trading and the impact of different variables on profitability. By experimenting with different inputs, they can gain a deeper understanding of the risks and rewards involved.

How to Use an Options Profit Calculator: A Step-by-Step Guide

Using an options profit calculator is typically straightforward. Here’s a general guide:

- Choose a Calculator: Select a reputable options profit calculator. Many online resources and brokerage platforms offer this functionality.

- Input Data: Enter the required data, including the underlying asset price, strike price, premium, expiration date, number of contracts, and any commissions or fees.

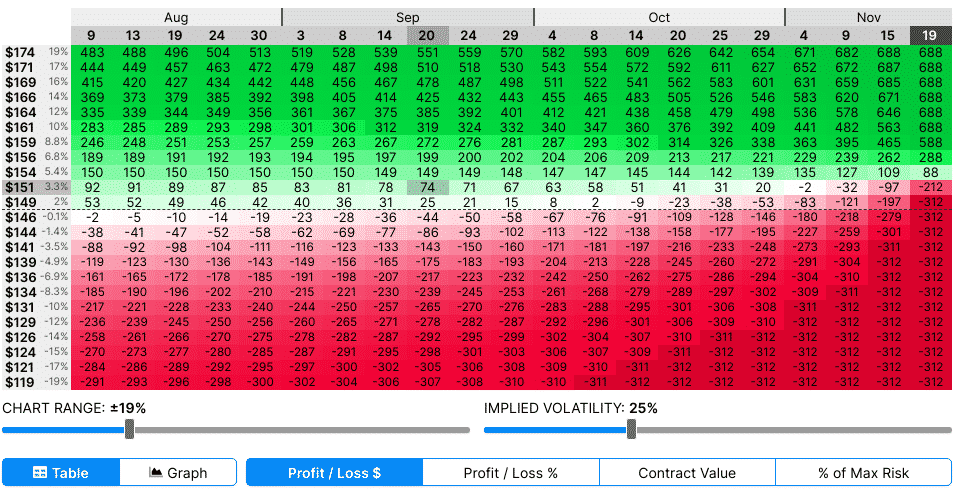

- Analyze the Results: Review the profit/loss graph and table generated by the calculator. Pay attention to the breakeven point, maximum profit, and maximum loss.

- Adjust Parameters: Experiment with different scenarios by adjusting the input parameters. For example, see how the profit/loss changes with different underlying asset prices or expiration dates.

- Make Informed Decisions: Use the insights gained from the calculator to refine your trading strategy and make more informed decisions.

Different Types of Options Profit Calculators

Several types of options profit calculators are available, each catering to different needs and levels of complexity:

Basic Calculators

These calculators are simple and easy to use, ideal for beginners. They typically focus on single-leg options strategies, such as buying calls or puts.

Advanced Calculators

Advanced calculators offer more sophisticated features, such as the ability to analyze multi-leg strategies (e.g., spreads, straddles, strangles), incorporate implied volatility, and generate detailed profit/loss curves.

Brokerage Platform Calculators

Many brokerage platforms provide built-in options profit calculators, seamlessly integrated with their trading tools. These calculators often offer real-time data and advanced charting capabilities.

Spreadsheet-Based Calculators

For those who prefer a more customizable approach, spreadsheet-based calculators offer flexibility and control. Users can create their own models and tailor them to their specific needs.

Common Mistakes to Avoid When Using an Options Profit Calculator

While an options profit calculator is a valuable tool, it’s important to use it correctly and avoid common pitfalls:

- Inaccurate Data: Ensure that all input data is accurate and up-to-date. Even small errors can significantly impact the results.

- Ignoring Commissions and Fees: Always factor in commissions and fees, as they can eat into your profits.

- Over-Reliance on the Calculator: Remember that the calculator provides estimates, not guarantees. Market conditions can change rapidly, and actual results may vary.

- Neglecting Implied Volatility: Implied volatility plays a crucial role in options pricing. Advanced calculators allow you to incorporate implied volatility into your analysis.

- Not Considering Early Exercise: In some cases, options can be exercised before the expiration date. Factor this possibility into your analysis.

Advanced Features and Considerations

Beyond the basic functionalities, advanced options profit calculators offer features that cater to more sophisticated trading strategies:

Implied Volatility Analysis

Implied volatility (IV) is a measure of the market’s expectation of future price fluctuations. Advanced calculators allow traders to input IV and assess its impact on option prices and profitability. Understanding IV is crucial for making informed decisions about buying or selling options.

Greeks Integration

The Greeks (Delta, Gamma, Theta, Vega, Rho) are measures of an option’s sensitivity to various factors, such as changes in the underlying asset price, time decay, and volatility. Some calculators integrate the Greeks, providing traders with a more comprehensive understanding of the risks and rewards associated with their options positions. [See also: Understanding Option Greeks]

Probability Analysis

Advanced calculators may incorporate probability analysis, estimating the likelihood of an option expiring in the money (ITM) or out of the money (OTM). This can help traders assess the probability of success for their options strategies.

Customizable Scenarios

The ability to create customizable scenarios is invaluable for stress-testing options strategies. Traders can simulate different market conditions, such as sudden price spikes or declines, and assess the impact on their positions.

Real-World Examples of Using an Options Profit Calculator

To illustrate the practical application of an options profit calculator, consider the following examples:

Example 1: Covered Call Strategy

An investor owns 100 shares of a stock trading at $50 per share. They decide to sell a covered call option with a strike price of $55 and a premium of $2 per share. Using an options profit calculator, they can analyze the potential profit and loss under different scenarios:

- If the stock price remains below $55 at expiration, the option expires worthless, and the investor keeps the $200 premium (100 shares x $2).

- If the stock price rises above $55 at expiration, the option is exercised, and the investor sells their shares at $55, earning an additional $500 (100 shares x $5). However, they forgo any potential gains above $55.

Example 2: Protective Put Strategy

An investor owns 100 shares of a stock trading at $100 per share. They purchase a protective put option with a strike price of $95 and a premium of $3 per share. Using an options profit calculator, they can assess the downside protection provided by the put option:

- If the stock price remains above $95 at expiration, the put option expires worthless, and the investor loses the $300 premium (100 shares x $3).

- If the stock price falls below $95 at expiration, the put option is exercised, protecting the investor from further losses. For example, if the stock price falls to $90, the investor can sell their shares at $95, limiting their loss to $800 ($5 loss per share + $3 premium).

The Future of Options Profit Calculators

As technology continues to evolve, options profit calculators are becoming increasingly sophisticated. Future developments may include:

- Artificial Intelligence (AI) Integration: AI-powered calculators could provide more accurate predictions and personalized recommendations.

- Real-Time Scenario Analysis: Calculators could dynamically adjust to changing market conditions, providing real-time profit/loss projections.

- Enhanced Visualization: Interactive charts and graphs could offer a more intuitive and user-friendly experience.

- Integration with Trading Algorithms: Calculators could be integrated with automated trading algorithms, allowing for seamless execution of options strategies.

Conclusion

An options profit calculator is an essential tool for anyone involved in options trading. By providing a clear and concise analysis of potential profits and losses, it empowers traders to make more informed decisions, manage risk effectively, and optimize their trading strategies. Whether you’re a beginner or an experienced trader, incorporating an options profit calculator into your toolkit can significantly enhance your chances of success in the dynamic world of options trading. Remember to use it wisely, understand its limitations, and continuously refine your trading approach based on market conditions and your own risk tolerance. Using an options profit calculator alongside other tools can allow you to find the best opportunities. The options profit calculator is just one of the tools that can help you to succeed.